Factsheet

The most important at a glance

Marketing - advertisement

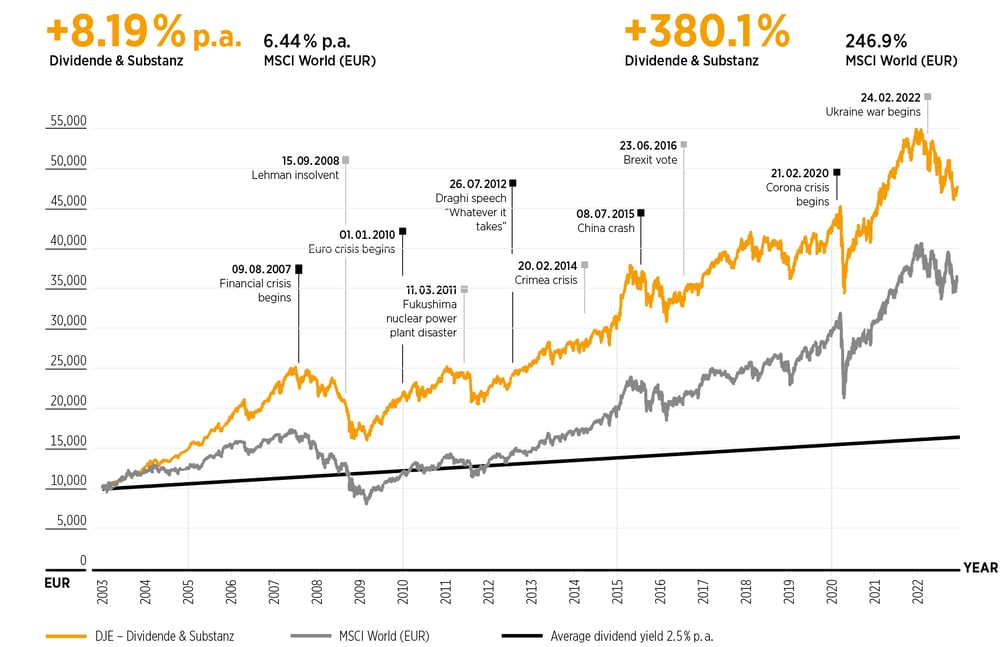

With its focus on investor-friendly corporate policies, DJE – Dividende & Substanz is a cornerstone of the DJE strategies. The global equity fund combines dividend income with share price gains and has been managed by

Dr. Jan Ehrhardt since day one. The fund celebrated its 20th anniversary on January 27, 2023.

Source: Scope Investment Awards 2022, as of November 2021 - for more information on this award, visit: www.scope-awards.com

Awards and many years of experience do not guarantee investment success.

The DJE – Dividende & Substanz has an above-average dividend yield compared with global equities. In addition, the fund management pays attention to share buybacks, which make the shares remaining on the market more expensive. This also brings sectors into focus that tend to let their investors participate in the company's success through share buybacks, for example large technology groups. In principle, the focus on the substance of companies, such as return on equity, free cash flow and debt-to-equity ratio, helps to keep volatility below average.

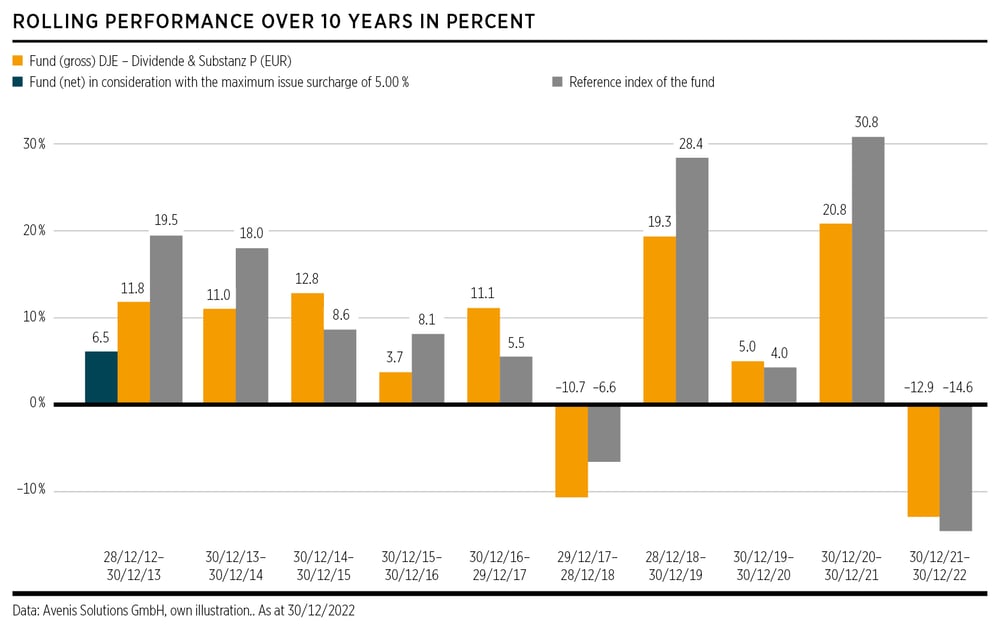

This approach has enabled the fund to successfully weather more than one crisis since its launch and clearly outperform its benchmark index MSCI World (EUR) during this period.

Source: Bloomberg, own presentation. Period: Jan. 27, 2003 to Dec. 30, 2022. The benchmark index is the MSCI World Index (EUR). Performance calculated according to the BVI method, i.e. excluding the front-end load. The funds are actively managed by DJE and, if a benchmark index is indicated, without reference to it. The performance graphs and tables presented are based on own calculations and were calculated according to the BVI method and illustrate past performance. Past performance is not indicative of future returns. The gross performance (BVI method) takes into account all costs incurred at fund level (e.g., the management fee), while the net performance additionally includes the front-end load. Further costs may be incurred individually at customer level (e.g. custody fees, commissions and other charges). Model calculation (net): An investor wishes to purchase units for 1,000 euros. With a maximum issue surcharge of 5.00%, he must pay a one-off purchase fee of 50.00 euros. In addition, custody account costs may be incurred, which reduce the performance. The custody account costs can be found in your bank's list of prices and services.

.jpg?width=600&height=314&name=LP_DS_Portriat_DrJanEhrhardt_600x314%20(002).jpg)

Dr Jan Ehrhardt is Vice Chairman of the Board of DJE. His primary responsibilities include amongst others: private wealth management, research and portfolio management. Moreover he is responsible for the management of the equity funds DJE – Dividende & Substanz, DJE – Asien and the balanced fund DJE – Zins & Dividende.

Stefan Breintner is the Head of Research and Portfolio Management at DJE. Since July 2019 he is the co-manager of the DJE – Zins & Dividende, DJE – Dividende & Substanz and the DJE – Asien. Moreover, he manages the DJE Gold & Stabilitätsfonds and the DJE – Gold & Ressourcen as lead fund manager. He also heads the ESG committee since 2019.

Note: This is a marketing advertisement. Please read the prospectus of the relevant fund and the PRIIP KID before making a final investment decision. These documents can be obtained free of charge in German at www.dje.de under the relevant fund. A summary of investor rights can be accessed in German free of charge in electronic form on the website at www.dje.de/summary-of-investor-rights. The funds described in this marketing announcement may have been notified for distribution in different EU Member States. Investors should note that the relevant management company may decide to discontinue the arrangements it has made for the distribution of the units of your funds in accordance with Directive 2009/65/EC and Article 32a of Directive 2011/61/EU. All information published here is for your information only, is subject to change and does not constitute investment advice or any other recommendation. The sole binding basis for the acquisition of the relevant fund is the above-mentioned documents in conjunction with the associated annual report and/or the semi-annual report. The statements contained in this document reflect the current assessment of DJE Kapital AG. The opinions expressed may change at any time without prior notice. All information in this overview has been provided with due care in accordance with the state of knowledge at the time of preparation. However, no guarantee or liability can be assumed for the correctness and completeness.

© 2025 DJE Kapital AG